China’s Tech Crackdown Is Cooling Hong Kong’s IPO Market place

New Hong Kong listings are monitoring at their slowest tempo because the aftermath of the international economic disaster, as weaker markets and China’s clampdown on its most important tech companies chill sentiment.

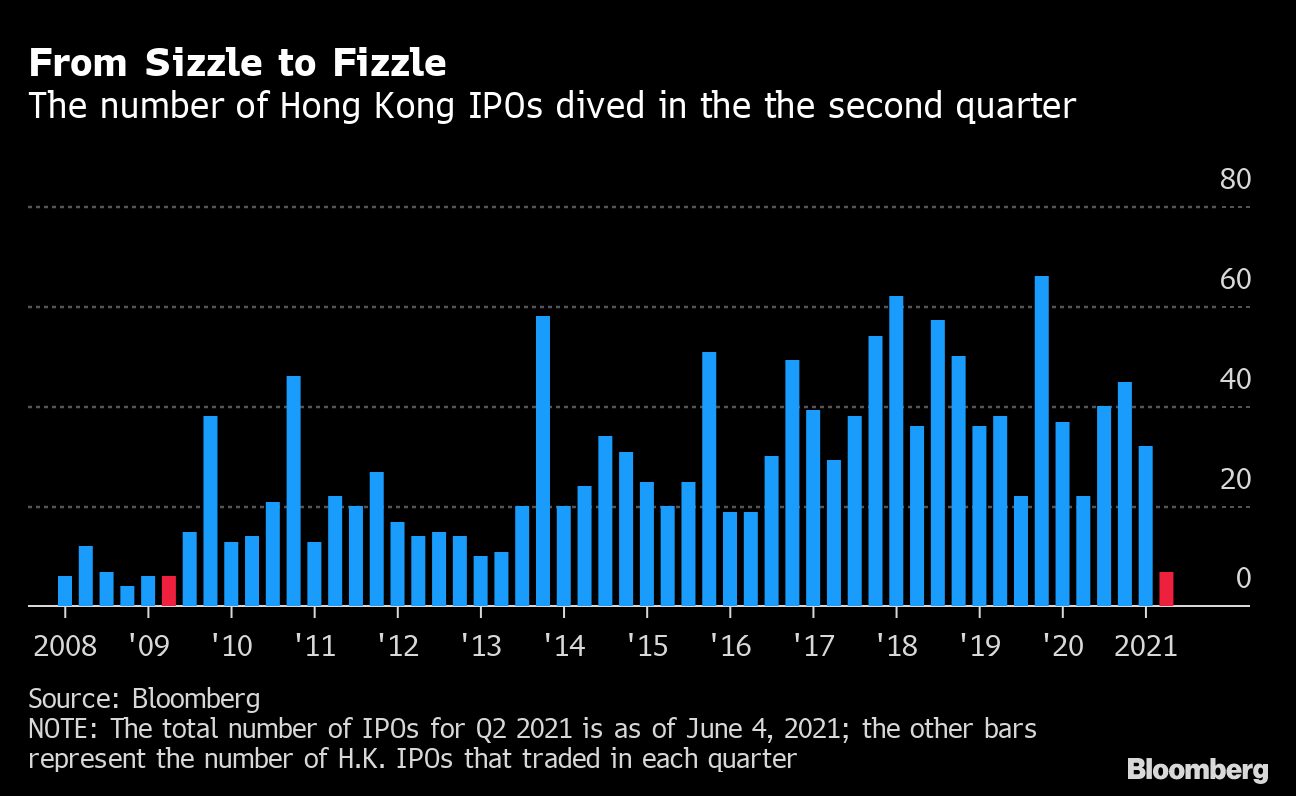

Just 7 firms have absent general public in the 2nd quarter so considerably — on track for the fewest given that 2009, according to data compiled by Bloomberg. The muted next-quarter activity stands in sharp contrast to the hurry to go general public found last 12 months or even at the get started of 2021.

Initially-day performances have also struggled: May’s first community offerings – which includes warehouse and distribution enterprise JD Logistics Inc. and assets supervisor Central China Administration Co. – delivered the worst average debut general performance in 15 months, the data exhibit.

The interesting-off will come as China slapped a history wonderful on Alibaba Team Keeping Ltd. and requested 34 of its biggest tech providers to rectify any anti-competitive business enterprise methods. That’s producing some companies extra skittish about heading community and investors get worried about even further actions from regulators. China has mentioned the moves are to guard people and maintain monetary steadiness.

“Investors are no extended comfortable paying out sky-higher valuations for some businesses,” said Louis Tse, Hong Kong-primarily based controlling director at Rich Securities Ltd. “Because of the intervention of the authorities, some issuers will have to revise down their multiples.”

China’s best-three tech firms Tencent Holdings Ltd., Alibaba Team Holding Ltd. and Meituan have shed more than $400 billion in worth from highs just four months ago. Hong Kong’s stock market place tumbled into a technical correction before this 12 months, dragging valuations even further. The benchmark Cling Seng Index is a person of the world’s worst performers considering the fact that its February higher.

As a end result, cash elevated on the Hong Kong stock exchange this yr is only 50 percent of its levels last yr, impacting the city’s place as a top rated fundraising hub. In comparison, quantity on the Nasdaq has currently surpassed its 2020 selection, many thanks to a increase in blank-check out corporation listings earlier this year.

To be confident, Hong Kong’s 12 months-to-day IPO quantity is however extra than triple the similar time period previous year, with nearly $23.9 billion lifted. Meanwhile, the U.S. SPAC increase is fizzling out.

Advancement Entice

Concerns about mounting inflation are also generating tech firms going public a more challenging sell as traders dump shares with loaded valuations. Beijing’s scrutiny on corporations which includes know-how and education has also compelled investors to scale back earnings forecasts, buyers say.

“We have observed some volatility and that has reflected on investors’ hunger, but offers that are priced properly will get performed,” said Francesco Lavatelli, head of fairness capital marketplaces for the Asia Pacific location at JPMorgan Chase & Co..

Fintech organization Bairong Inc. slumped 16% when it started trading in late March, although wellbeing-care business Zhaoke Ophthalmology Ltd. dropped 15% in late April. JD Logistics Inc., which raised $3.2 billion, shut only 3% earlier mentioned its presenting rate in its debut not too long ago in distinction to yet another JD.com unit, JD Health Global Inc., which surged 56% on its initially day final year.

Unhappy Returns

On regular, May perhaps listings dropped 6% on working day 1, the worst since Feb. 2020

Resource: Bloomberg

Following Blockbuster

The test for no matter if Hong Kong’s IPO market place can phase a revival will occur from some approaching listings, with exercise found to be selecting up all over again with share sales by businesses together with a dairy organization and a maker of invisible teeth aligners.

Significant listings contain China Youran Dairy Group Ltd.’s supplying of as a lot as $799 million, which kicked off its roadshow on Monday. Biopharmaceutical business CARsgen Therapeutics Holdings Ltd. is wanting to elevate as considerably as $401 million and also began using investor orders on Monday.

Angelalign Engineering Inc., China’s major invisible orthodontic producer, introduced an IPO of as significantly as $375 million on Thursday. The latter’s retail tranche was previously about 674 occasions oversubscribed on its to start with day of get-getting, the Hong Kong Economic Journal documented.

At the very least 3 other firms commenced gauging investor demand from customers for their IPOs on Monday, such as Chinese bubble tea chain Nayuki Holdings Ltd. and two home management firms.

Traders are also closely looking at the reception to mega flotations, between them Chinese gaming big NetEase Inc.’s audio streaming arm which filed late May possibly for a Hong Kong IPO that could raise about $1 billion.

“The industry requires at least two or 3 blockbuster IPOs to revive the sentiment. That suggests you want each subscription ratio and very first-working day effectiveness to surprise the marketplace on the upside,” stated Kenny Wen, Everbright Sun Hung Kai strategist. “The very good times of the IPO market are not coming back again yet.”

— With help by David Watkins

(Adds particulars of forthcoming IPOs in paras 12-15)