‘Flash recession’ could hit markets by the tumble

Toews Asset Management CEO Phil Toews shares perception on investing amid transferring markets.

Marketplaces are acting like the worldwide economy is headed for a slowdown, in accordance to Financial institution of The united states.

Unparalleled quantities of fiscal and financial stimulus have been unleashed into the world-wide financial system, nevertheless reopening trades and other trades indicating enhanced urge for food for possibility-getting are viewing a W-formed restoration, indicating momentum is petering out.

The tale of the tape is “recessionary,” wrote Michael Harnett, chief investment strategist at Bank of The usa, pointing to the action in U.S. Treasurys, commodities and worldwide fairness markets.

In the U.S., the produce curve when measured by the 5-year and 30-year yields, fell to 110 basis details this week, the flattest in a year. A flatter generate curve indicates expansion is probably to sluggish in the months ahead.

Huge Revenue Supervisors RATCHET UP Anticipations FED WILL ANNOUNCE TAPER THIS Year

At the identical time, international inventory markets, excluding U.S. technologies shares, are unchanged in excess of the earlier 8 months, in accordance to Hartnett. Commodities like oil, copper and palladium, which reward from a rising overall economy, have fallen up to 23% from their modern peaks.

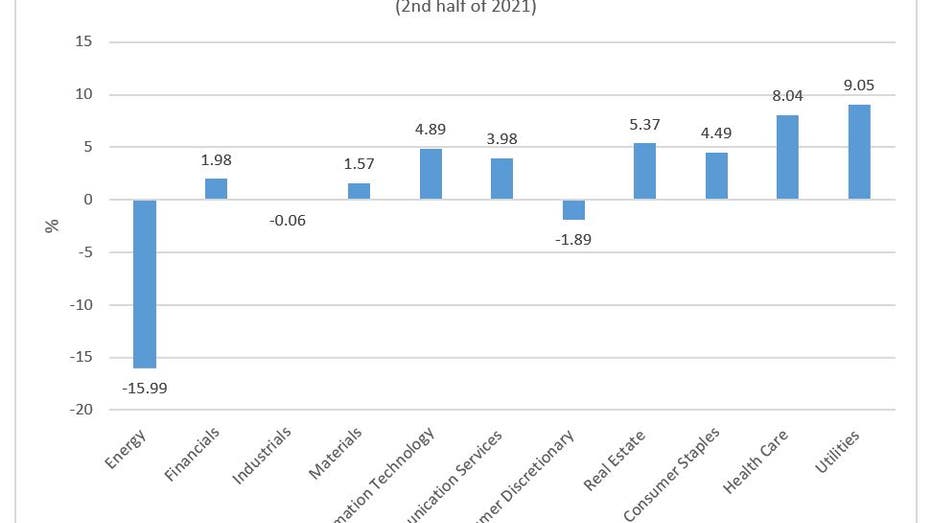

Inside the S&P 500, the defensive sectors, like utilities, well being treatment, REITs and purchaser staples, are amongst the best performers for the duration of the 2nd half of this yr.

Dow Jones Market Knowledge, FactSet

The careful trade arrives as U.S. shopper self confidence plunged to 10-yr very low, a chip scarcity has triggered a sharp drop in international car creation, and China’s development is threatened by additional lockdowns aimed at slowing the distribute of COVID-19.

This as the Federal Reserve minutes unveiled Wednesday signaled the central lender could begin to taper its asset purchases as quickly as this calendar year.

All of this sets the phase for the “growing hazard of [an] autumn ‘flash economic downturn” that is most likely to be discovered in a sharp drop in world buying administrators indexes, Hartnett wrote.

Hartnett warns investors of damaging returns for stocks and suggests buyers should really own high-quality defensive names into calendar year end. Continue to, his very long-time period secular see is that inflation will earn out more than deflation.

Analysts somewhere else on Wall Avenue are much more optimistic.

Goldman Sachs before this thirty day period elevated its calendar year-end S&P 500 rate goal to 4,700, up from 4,300, owing to its expectation of “stronger income growth and extra pre-tax earnings margin growth.”

It warned that uncertainty all-around fiscal and financial coverage would stir current market volatility afterwards this year.

Mark Haefele, chief expense officer at UBS International Wealth Administration, agrees.

GET FOX Company ON THE GO BY CLICKING Listed here

He thinks traders need to “put together for volatility” but that “powerful nominal growth and exceptional policy guidance symbolize ‘zero gravity’ situations that are possible to persist for the following six to 12 months.”

Haelfe says the S&P 500 is likely to get to 5,000, or 13% earlier mentioned present levels, by the stop of 2022.