Prudential Financial up amid retirement arm sale report markets strike documents

U.S. insurance coverage stocks rallied and the broader market place achieved document highs this 7 days in the wake of superior-than-anticipated macroeconomic experiences and the first foray into initially-quarter earnings.

The Commerce Department claimed April 15 that retail income jumped 9.8% in March, the most significant improve because May well 2020. The increase was credited to pandemic relief checks and the easing of COVID-19-associated limitations across the state. Also, new jobless statements fell to 576,000, their most affordable stage given that the pandemic took hold in the U.S., and much far better than the forecast 700,000.

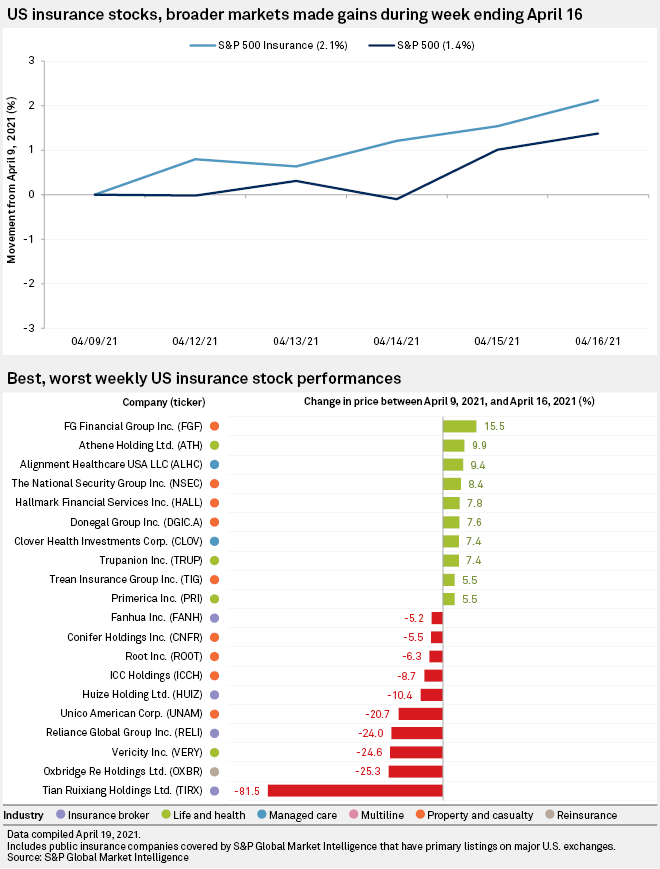

The S&P 500 rose 1.37% to 4,185.47 for the 7 days ending April 16, though the SNL U.S. Insurance policy Index attained 2.65% to 1,375.32.

Bloomberg Information documented earlier this 7 days that Prudential Financial Inc. is seeking to sell its whole-service retirement company for much more than $2 billion and is doing the job with a money adviser to obtain prospective suitors. The enterprise experienced no comment on the report.

Current market reaction in the wake of the report was modestly constructive. Prudential’s share rate rose a minimal above 2% on April 14 and completed the 7 days up 4.80%.

The full-services small business, if offered, need to generate price “considerably higher than $2 billion,” Credit rating Suisse analyst Michael Zaremski explained in a notice. He said the company probably generates a the greater part of Prudential’s retirement segment’s soon after-tax earnings.

“Provided that recent retirement transactions have gone for up to 20x existing earnings, we consider Prudential could crank out considerable price from divesting this organization,” Zaremski claimed.

Barclays analyst Tracy Dolin-Benguigui claimed a prospective sale would not translate into buybacks, which could clarify the market’s reaction. She stated the total-assistance retirement small business appears reduce on the pecking get relative to other capital-intensive companies. Prudential has already signaled that it designs to return $10 billion of cash to shareholders in the subsequent three a long time, Benguigui reported in an interview.

“At the exact time, they are hunting to reallocate $5 to $10 billion of funds in the higher growth organizations, so we would translate that to think inorganically within just [Prudential Global Investment Management] in emerging marketplaces,” she extra.

Athene Holding Ltd. was a major performer for the 7 days in the existence sector, leaping 9.91%. Piper Sandler analyst John Barnidge in an interview explained banking companies that take care of alternative investments have been reporting reliable earnings, which is superior news for Athene’s portfolio. He also famous that the price tag change for the merger amongst Apollo and Athene has narrowed, which has had a favourable impact.

In other places in the daily life area, Unum Team was up 5.32% and Lincoln Nationwide Corp. improved 3.68%

Good start out in P&C

The Progressive Corp. led off earnings season reporting a 114% 12 months-in excess of-12 months increase in web revenue to $1.48 billion, or $2.51 for each share, from $692.7 million, or $1.17 per share, a 12 months in the past.

Net earnings attributable to the corporation for the thirty day period of March jumped 12 months about 12 months to $567.9 million, or 96 cents per share, from $318.6 million, or 54 cents for every share, in the prior-12 months time period.

Progressive included 3.22% on the 7 days.

The Allstate Corp., which rose 4.36% for the 7 days, declared approximated pretax catastrophe losses of $252 million for March. The losses had been composed of 6 occasions at an believed mixed charge of $208 million, moreover enhanced prior-period reserve estimates of $44 million.

UnitedHealth sets speed for managed treatment

UnitedHealth Team Inc.’s to start with-quarter earnings report highlighted what was a strong 7 days for managed treatment insurers. The business logged web earnings attributable to frequent shareholders of $4.86 billion, up from $3.38 billion a calendar year before. It also increased its comprehensive-calendar year internet and altered earnings outlooks.

Stephens analyst Scott Fidel in a be aware reported the constructive final results “will reset trader expectations for an even stronger managed treatment earnings encounter than beforehand expected.”

UnitedHealth’s stock climbed 3.91%, this 7 days, while Humana Inc. rose 4.20% and Anthem Inc. attained 4.05%.